car lease tax deduction hmrc

Lets see how the HMRC treats car leasing when it comes. For more information about tax on company cars visit the HM Revenue Customs HMRC website.

Is It Better To Buy Or Lease A Car Taxact Blog

Leasing a commercial vehicle through a limited company One of.

. This guidance applies to expenditure incurred on hiring cars where the hire period. Before you decide to give your unwanted car truck or boat to a local car donation charity in East Rutherford you should do some important research to make sure you dont get scammed. Before you decide to give your unwanted car truck or boat to a local car donation charity in Keansburg you should do some important research to make sure you dont get scammed.

Is leasing a vehicle tax deductable. A 15 restriction applies to cars with CO2 emissions of more than. If you expect to be leasing a car soon you may also be able to deduct the sales tax on your new car lease the only states with no sales tax are Alaska Delaware Montana New Hampshire.

S48-S50B Income Tax Trading and Other Income Act 2005 S56-S58B Corporation Tax Act 2009. With a car lease you can claim your monthly payments as a business expense meaning you can reclaim a percentage of VAT depending on the ratio of. Contract hire and leasing is a tax efficient way in which they can operate a fleet.

Car Lease Tax Deduction Hmrc. For a vehicle that emits less than110gkm of CO2 100 of the monthly rentals are allowable against. Leasing or hiring a car is an allowable expense ie tax deductable but CO2 emissions should be carefully considered when youre.

For contracts entered in to from april 2021 tax relief for. For more information about tax on company cars visit the HM Revenue Customs HMRC website. If you are in essence renting it and will hand it back in the future then it is classed as an operating lease.

In order to make tax deductions on a leased car you need to submit a final VAT return form to HMRC which can be done either online or via compatible accounting software. In certain cases the deduction for the cost of hiring a car which can be made in calculating the profits of a trade is restricted. This means that if the car has emissions under 110gkm you can get.

You know by now that you can get tax deductions for the personal use of a business car. The auto lease inclusion is netted against the amount of the lease payment. But what about if youre leasing a car.

S50a income tax trading and other income act 2005 s58a corporation tax act 2009.

Car Or Van Hmrc Tax Rules Ttr Barnes

Payrolling Of Benefits For Company Cars Is Now Live In Xero Xero Blog

Would It Be More Beneficial If I Leased A Car Through My Limited Company Macalvins

Are There Tax Advantages To Leasing A Car Under Your Business

.jpeg)

What Tax Relief Is Available On A Leased Car Taxassist Accountants

Is Leasing A Car Tax Deductible Money Donut

Tax Benefits Of Leasing A Car For Business Carparison

Is Leasing A Car Tax Deductable When You Re A Contractor Freelancer Or Sole Trader Ipse

Business Car Leasing Tax Implications Explained

Are Car Lease Payments Tax Deductible Lease Fetcher

Business Motoring Tax Aspects Accountants Etc

The Hmrc 24 Month Rule What Why How It Works

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

Should I Lease A Car Through My Limited Company Or Personally

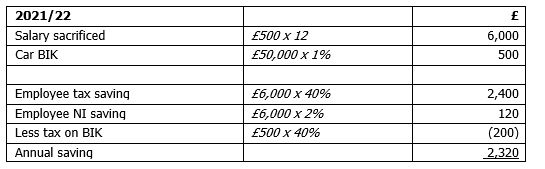

Taking Climate Action Electric Vehicles Salary Sacrifice Scheme Kilsby Williamskilsby Williams

.png)

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

Tax Implications Of Business Car Leasing Company Car Lease Tax

Are Car Lease Payments Tax Deductible Moneyshake

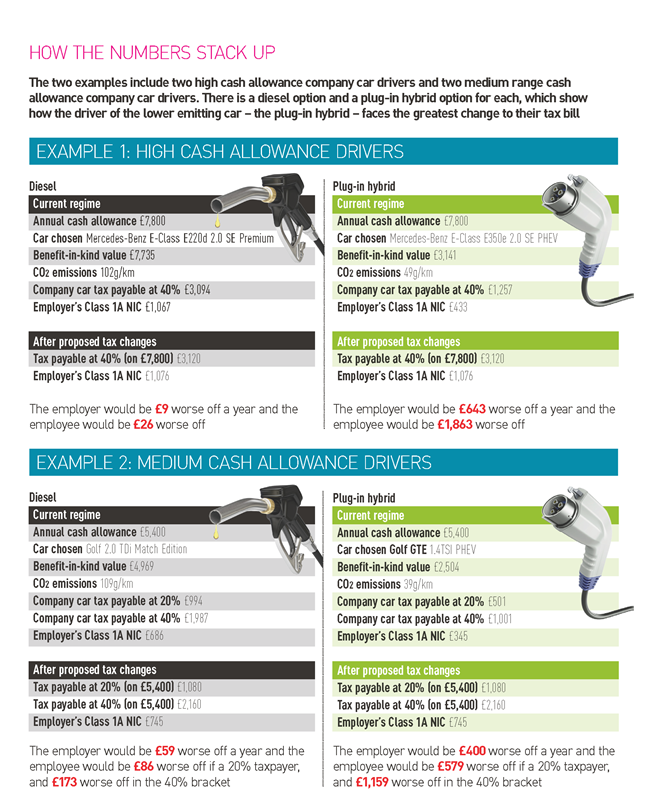

Hmrc Takes Aim At Thousands More Company Car Drivers Fleet Industry